A recent investigation published in JAMA Network Open reveals a critical link between carrying a High-Deductible Health Plan (HDHP) and adverse survival rates for cancer patients. The study found that individuals facing substantial out-of-pocket costs associated with HDHPs demonstrated worse overall and cancer-specific survival compared to those with traditional insurance coverage.

This finding underscores the difficult financial trade-offs Americans confront as healthcare expenditures escalate, pushing more consumers toward plans designed to lower monthly premiums by increasing upfront costs. HDHPs require policyholders to pay thousands before the insurer begins cost-sharing, a mechanism known to cause care deferral.

Researchers, led by Justin Barnes at the Mayo Clinic in Rochester, Minnesota, specifically examined survival data for cancer patients, a population highly dependent on consistent and timely medical intervention. While previous data established that high deductibles lead to delayed diagnostics and skipped treatments, this research sought a more direct correlation with mortality.

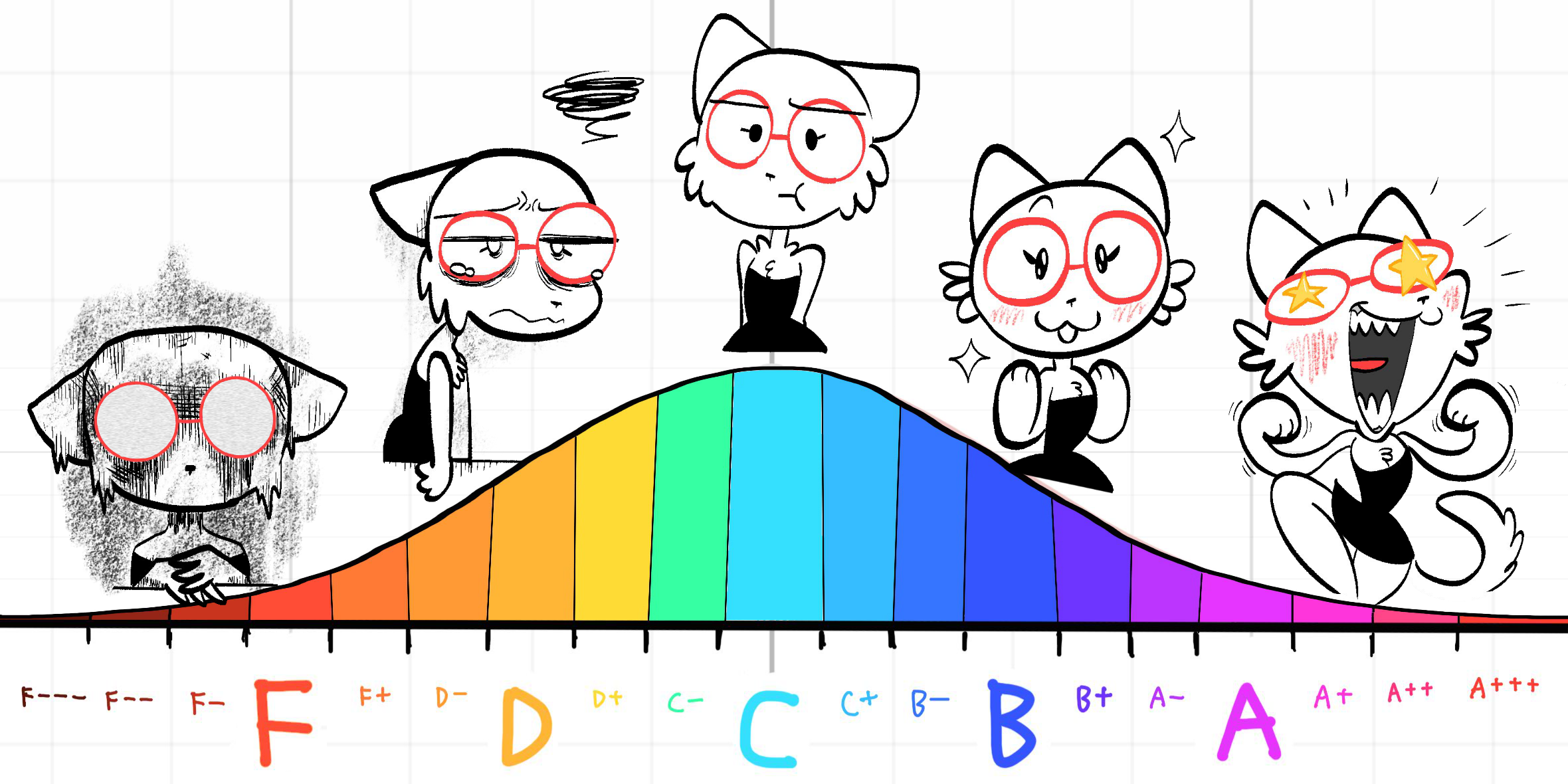

For context, the study defined HDHPs based on deductibles ranging from $1,200 to $1,350 for individuals during the 2011 to 2018 period, with corresponding higher thresholds for families. Current market conditions exacerbate this issue, particularly for those utilizing the Affordable Care Act (ACA) marketplace.

Premiums for ACA plans have reportedly more than doubled this year following the expiration of crucial federal tax credits, according to reports from the publication. Early enrollment data for 2026 suggests a trend toward consumers selecting Bronze-tier plans, which are predominantly high-deductible options.

For example, the average individual deductible for an ACA Bronze plan in 2026 now stands near $7,500, according to data compiled by KFF. This substantial financial hurdle directly impacts access to the continuous care oncology patients require for positive prognoses.

The implications extend beyond oncology, suggesting that financial toxicity embedded within certain insurance structures may translate into measurable public health detriments. Policymakers and insurers face renewed scrutiny regarding the balance between cost containment and patient access to essential services.

Future analysis will likely focus on whether regulatory adjustments or subsidies can mitigate the documented survival disparities linked to high consumer cost-sharing in health insurance products.